The Online Shopping Behavior Survey released by Mastercard in April 2015, measures consumers’ propensity to shop online. The survey was conducted at the end of last year and was based on interviews with 4000 respondents across eight markets in the Middle East and North Africa including the KSA, UAE, Qatar, Oman, Kuwait, and Lebanon.

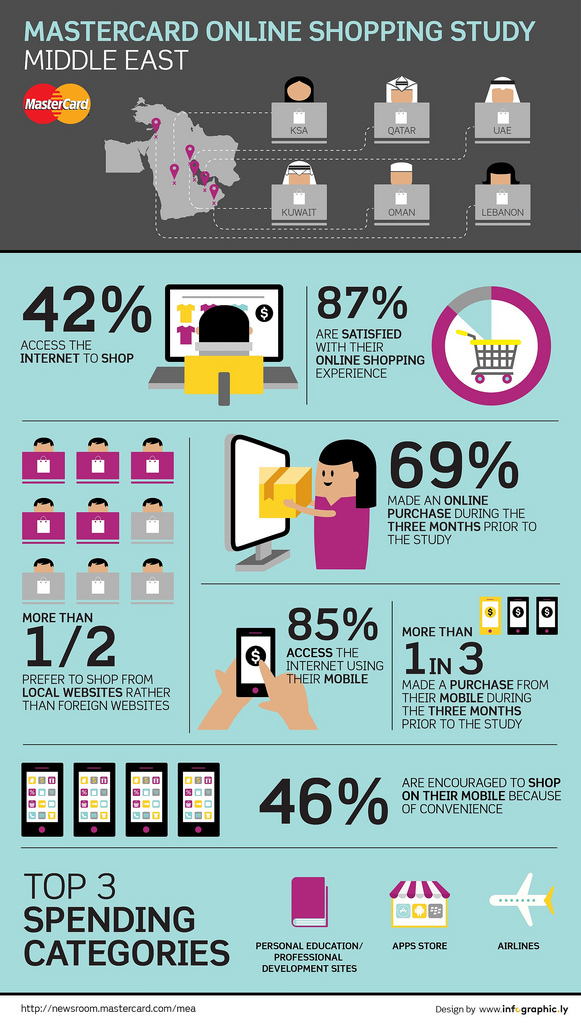

Across all the different countries, the most important factors impacting online shopping decisions are the price and value of the items on offer, the security of the payment facility, the user-friendliness and the reputation of the website. Below are the key findings related to the study compiled in an infographic

Saudi Arabia shows promise for online shopping growth

Nearly half of the respondents had made an online purchase during the 3 months prior to the study, of which 78% were satisfied with their online shopping experience.

25-34 year olds were found to be most likely to access the Internet for online shopping and the most popular sites that respondents had visited were Souq.com and Amazon. Other popular sites that attracted the highest levels of traffic included eBay, Saudi Airlines and Namshi. Respondents indicated a slight preference for local websites over foreign websites, citing a fear of hidden charges from retailers and the ability to find all the products they need locally as the main reasons for shopping on local websites.

Mobile shopping on the rise in Qatar

3 in 10 respondents made online purchases through their mobile phones during the 3 months prior to the study – an increase of 15% compared to 2013. An additional 1 in 6 respondents who had not purchased online yet said that they intended to do so in the next six months. The reasons given for shopping online via mobile phones included convenience, apps that make online shopping easy and the ability to shop while on the go.

Respondents purchased clothing and accessories primarily, followed by home appliances, electronic products and phone apps. Other frequently purchased items included hotel accommodation, airline tickets, computer software and personal or beauty care brands.

Online and mobile shopping grows significantly in Lebanon

59% of the survey’s respondents in Lebanon accessed the internet for online shopping in 2014, representing an increase of 45%compared to the previous year. The survey also found that 92% of the respondents who had made a purchase online were satisfied with their online shopping experience. The increase witnessed in online shopping amongst respondents in Lebanon was the highest compared to the rest of MENA.

Websites such as Shtrina, Shopinleb followed by Amazon and Getforless were found to be the most commonly visited sites for online shopping in Lebanon. Airlines enjoyed the highest level of absolute online spend, followed by hotels, supermarkets, hypermarkets, restaurants and food delivery services.

Online shopping witnesses continued steady growth in Oman

Women found to be more likely to make online purchases than men, and 45 to 49 year olds most likely to make a purchase online. Airlines were found to enjoy the highest absolute spend with a significant lead over other leading categories including travel products, home appliances and electronic products.

eBay is the most commonly visited site for online shopping, trailed by Yallahoman, Muscat360, Amazon and Alshop. Respondents in Oman were found to be more likely to purchase from foreign websites than they were in 2013 although they pointed out that local sites offered benefits such as convenience and lower costs.

Kuwait consumers top the list of online shoppers in the Middle East

95% of respondents made at least one purchase online during the 3 months prior to the survey. Developments in Kuwait’s internet infrastructure has allowed a number of companies to expand their businesses to include online offerings, especially as Kuwait’s technology-savvy consumers are well versed the with the benefits of cashless payments. The most commonly visited websites for shopping were Xcite, Souq.com and Blink. Other key sites that were visited include Ubuy, Letouch and Mrbabu. The share of foreign websites exhibited a significant decline both in terms of purchase occasions and online spends – signifying that Kuwaiti consumers strongly prefer shopping from local websites.

Online shopping continues to gain popularity in the UAE

Online is quickly becoming the norm for more shoppers in the UAE due to the high level of awareness amongst consumers about the convenience, speed and safety of their transactions. In the UAE, Souq.com emerged as the most commonly visited website for shopping online, with over 45% of respondents having made a purchase from the site during the three months leading up to the study. The next most visited site was Amazon.com, with 16% of respondents having purchased from it, reflecting UAE consumers’ preference for local websites over foreign sites.

4 powerful e-commerce marketing trends that brands should adopt:

Brands in the region should see these growing statistics as an opportunity; they must consider different ways to reach consumers in real-time. Here are a few digital strategies that can help marketers stay one step ahead:

– Think mobile optimized instead of mobile friendly: It’s not about just creating sites that work decently on mobile – it’s about adding value and creating a great customer journey on smartphones and tablets through loyalty apps or mobile services such as mobile ordering or mobile payment solutions.

– Focus on mobile advertising: This includes growing mobile ads format such as mobile display, mobile video, search and social ads that are a strong format on mobile because of their convergence with local-mobile targeting, mobile programmatic ads as well as in-app mobile ads that perform much better than mobile web ads.

– Create personalized experiences: Online stores have been serving personalized ads to prospective users since years. Many online stores also use personalized product displays and suggestion for registered users. As users become more comfortable with sharing some personal information with brands and trusted online stores, brands should start making more efforts on their online stores to offer a more meaningful personalization to users.

– Use social networks as shopping platforms: Over the last several years, brands have used social media to market their products, talk to customers, and even make merchandising decisions; but in the coming months, we anticipate brands to add “selling” to the list of things they can do on social sites (ie. the recent launches of shopping functionalities on the main social networks with Facebook’s and Twitter’s “buy” buttons)

No Comments